Ethylene Sinks as Crude Oil Challenges the 43 US$ Area

Sarasota, June 21st, 2017- 10:00 AM EDT--As predicted, the CLc1 crude oil future contract went directly to challenge the 44-42 support area showing yesterday a solid red bar, which tried to bounce right into the commodity closing bell.

Next serious support is the 39-41 US$ area, which is basically the January-February 2016 micro-double bottom shown by Clc1 on daily time frame.

Is this move the direct pathway to the very commented 30 US$/barrel price? Well, could be, but we would like to see a few things first:

· We obviously need to definitely break the referred double bottom at 41-39 area. I mean, we need to retest up that level from the bottom and to clearly fail the attempt. This is a basic conservative technical analysis concept: retest & fake to confirm the supply area

· Next thing we need is to receive support from the dollar, which means to keep a strong dollar movement, at least to start the referred crude oil down continuation below the 39 US$ level.

· Now, I mean today Wednesday June 21st, we have the crude oil trying to build demand into the 43-44 US$ area, which is a good test to gauge the strength of the bulls. Personally, I love a falling instrument trying to halt the down move. If that recovery attempt finally fails, the move continuation will be probably increased and accelerated into the down direction.

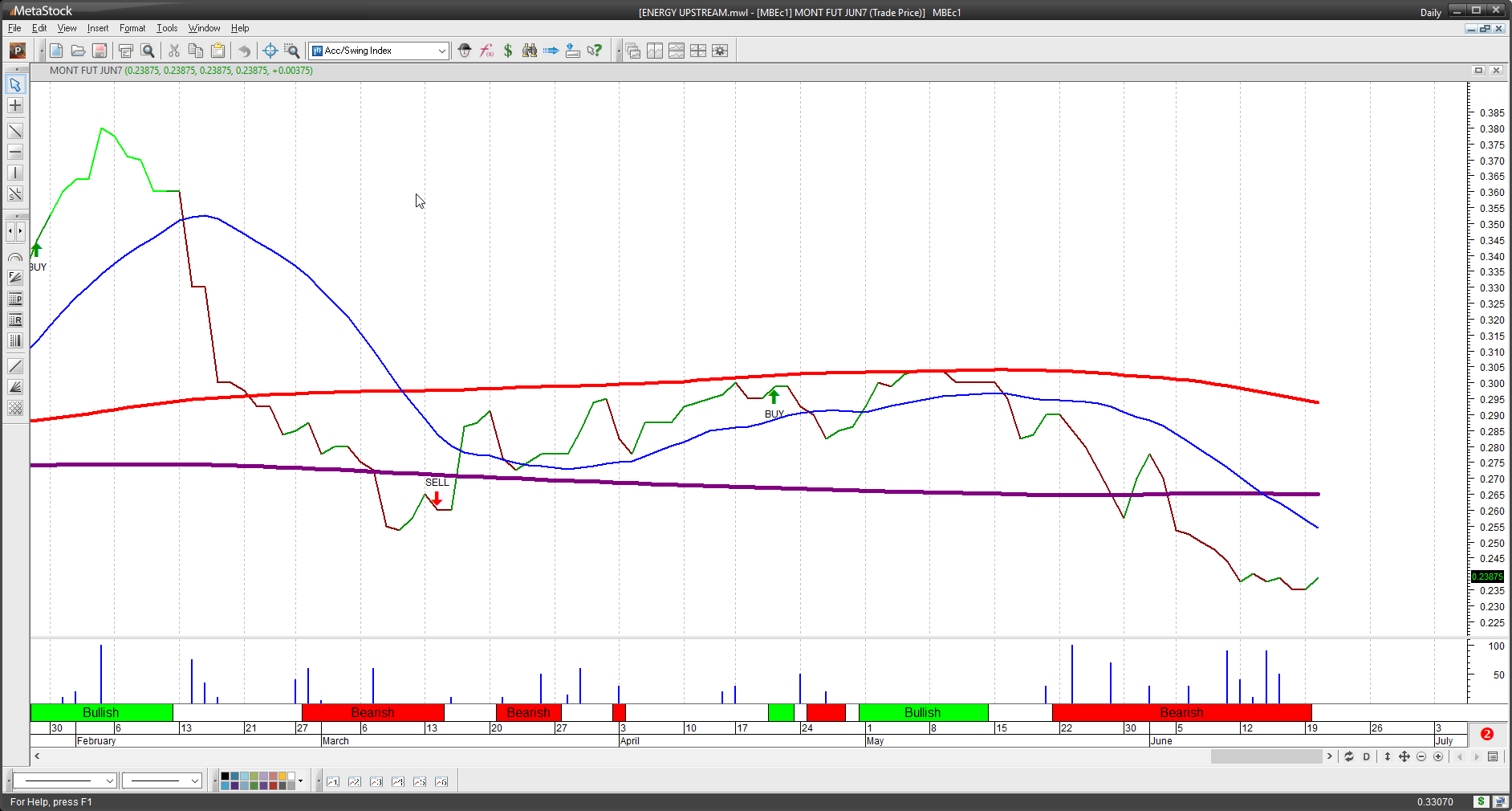

Ethylene and Naphtha Continue Showing Weakness

Note that now we are getting alignment from up-stream: crude oil, naphtha and ethylene all of them are showing weakness. Naphtha is still holding prices, but below the EMA 450, which is not bullish, but ethylene is definitely tanking into the 23 cts/pound level, which will start to make down pressure on polymers in some point.

This is very good for non-integrated petrochemicals which will improve margins if they are able to hold polymers prices.

Is possible to see crude oil prices looking for some continuation into or even under the 30 US$/barrel level?

From the technical point of view, is absolutely possible if that Jan-Feb 2016 double bottom formation is visited on increased selling volume again. Bases are frequently cracked if they are visited again and properly.

From the fundamental point of view, we can say that prices under 40 US$ clearly show crude oil extraction inviable for many drillers, which was shown by the recent double bottom formation into the 39 US$ area, which happened last Jan-Feb 2016.

Applying the traditional supply-demand concept, less drilling, means less supply, which could basically will lead oil to higher prices.

But the question we have to answer is whether we can or not effectively replace that “expensive” oil supply by a cheaper energy source such shale gas, which eventually makes possible the referred down move continuation for the whole energy market.

Actually, The key concept is how fast and how efficiently that crude oil replacement can be implemented globally.

But definitely the energy market is not the same when we compared today’s scenario with the corresponding January 2016 situation. Expectations for OPEC influence limiting supply is very unlikely to work for now, and at the same time USA increased a lot its supply not only from shale gas but also from the traditional crude oil.

In short, the energy market is living a unique historical moment pushing boundaries into a critical area, which could eventually lead us to manage a brand new production-consumption matrix in every industrial activity, with the obvious socio-economical global implications.