Energy

- Details

- Written by Adonis

- Details

- Written by Adonis

- Details

- Written by Adonis

Naphta UNc1 Future Contract Trying to Overcome Supply Area at 510-570 US$

Charts and Data provided by MetaStock and EIKON-Thomson Reuters. Alerts provided by e-globalTrading-AmericaPlast

- Details

- Written by Adonis

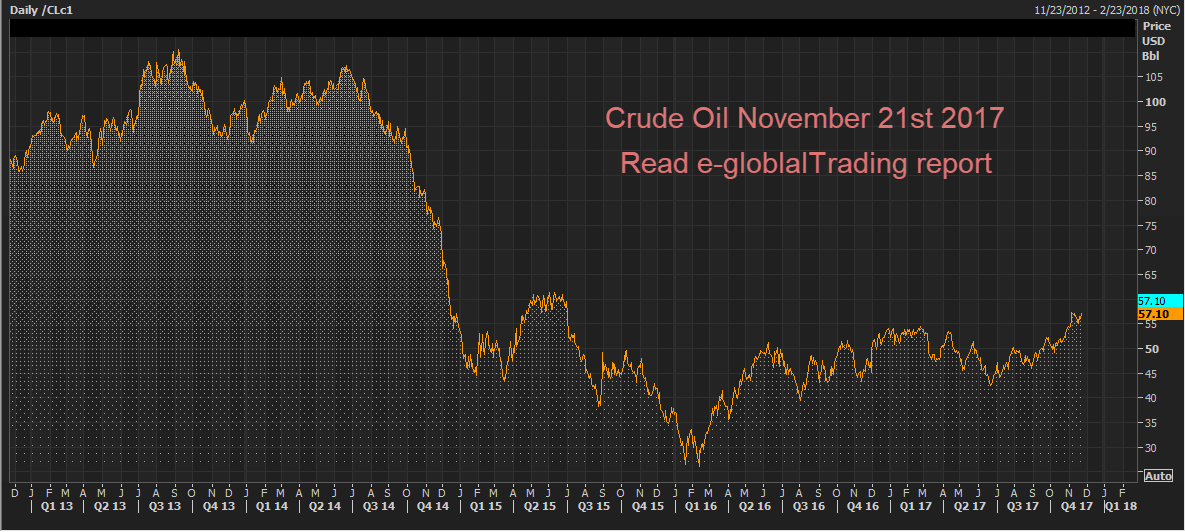

Crude Oil Showing Key Technical Event

The CLc1 Crude Oil future contract is now showing a key break-out right above a previous critical resistance area: the upper part of a wide trading box, which is shown below.

The referred trading box goes from 39,50 US$ to 55 US$, and is being left behind after the November 3rd break-out, which is marked as #1 technical event. After the referred # 1 break-out, CLc1 showed a moderated re-test using now the box as a support. This retest is marked as # 2 event.

Finally, the crude oil made a solid, almost potent green bar showing strenght, marked as # 3, and showing a BUY alert, form the referred box formation support.

Prices are now trying to overcome the recently formed resistance (supply) marked with the #4, which is a critical moment for crude oil, because is a very recent supply formation,which is not easy to be absorbed with moderated volume.

If crude oil finally keeps that 55 area as a support, we have good chances to see a serious attempt to penetrate the next supply area which is located between 56 US$ and 62 US$.

Charts and data provided by MetaStock and EIKON-Thomson Reuters, alerts provided by e-globalTrading

- Details

- Written by Adonis

FREE SAMPLE REPORT - DATE: September 3rd 2017

Trend Matrix

Harvey Impacts Ethylene, Naphtha and Polymers, Crude Oil and Gas Steady

Petrochemical facilities, ports and railroads networks were more or less seriously affected by Hurricane Harvey. Surveillance procedures are being conducted to determine when all of them will be able to be in operation again.

At the same time Gulf Offshore platforms are still under technical scrutiny to determine when they are able to resume regular operations.

Several important in-land crackers are out of duty, and that situation is putting price pressure on intermediate chemicals and polymers. Ethylene production was cut by 40% because of Harvey.

As a result, ethylene future prices jumped over the powerful 450 EMA and the 200 EMA as well, as you can observe at the corresponding MBEc1 future contract daily chart. Ethylene is now challenging the 30 cts/pound resistance level, with a more or less easy path until the 37-38 cts/pound area.

Alerts are provided by e-globalTrading, prices and data are provided by MetaStock powered by EIKON Thomson Reuters

But something very important to be highlighted: the MBEc1 Ethylene daily chart is showing a first BUY alert on August 22, well in advance of Harvey, confirming the strength of the previously started reversal + later up move.

The UNc1 Naphtha is also showing a strong up-move right into the 480-485 US$ supply area.

Meanwhile, polymers are also showing some bullish reaction but not so much. HDPE future prices are more or less unchanged at 0.43875 US$/pound and LLDPE jumped from 0.48 to 0.51 US$/pound.

Finally, crude oil and natural gas futures prices are still showing the previous weeks sideways behavior without any kind of strong up movements for now.

The US Dollar, tracked by the future DXc1 dollar index, is still into the 92.5 support area, at least until the real Hurricane Harvey economic impact will be assessed.

For more information please visit e-globalTrading